Coinbase Q2 2025 Results

See earnings preview published last week for full bullish analysis. Nothing has changed, thesis intact. On to the next Quarter!

After earnings bloodbath COIN 0.00%↑ dropped -16%. An overreaction in my opinion. Most of the numbers were in line with expectations; except they delivered a massive $1.5B of other income from strategic investments.

Market Reaction Context

Despite these positive financials, Coinbase stock COIN 0.00%↑ dropped from ~$375 pre-earnings to ~$314. This reflects market concerns about:

The sharp drop in trading volume (-34% QoQ)

The decline in MTUs (Monthly Transacting User)

Reduced retail engagement, which still drives a significant portion of profits

These short-term headwinds contrast with long-term tailwinds, including:

Strategic positioning as a public, compliant crypto platform

Institutional traction and global expansion

A lean, cash-rich operation ready to benefit from macro crypto growth

Stablecoin growth

New derivative revenues, and tokenized securities on the horizon

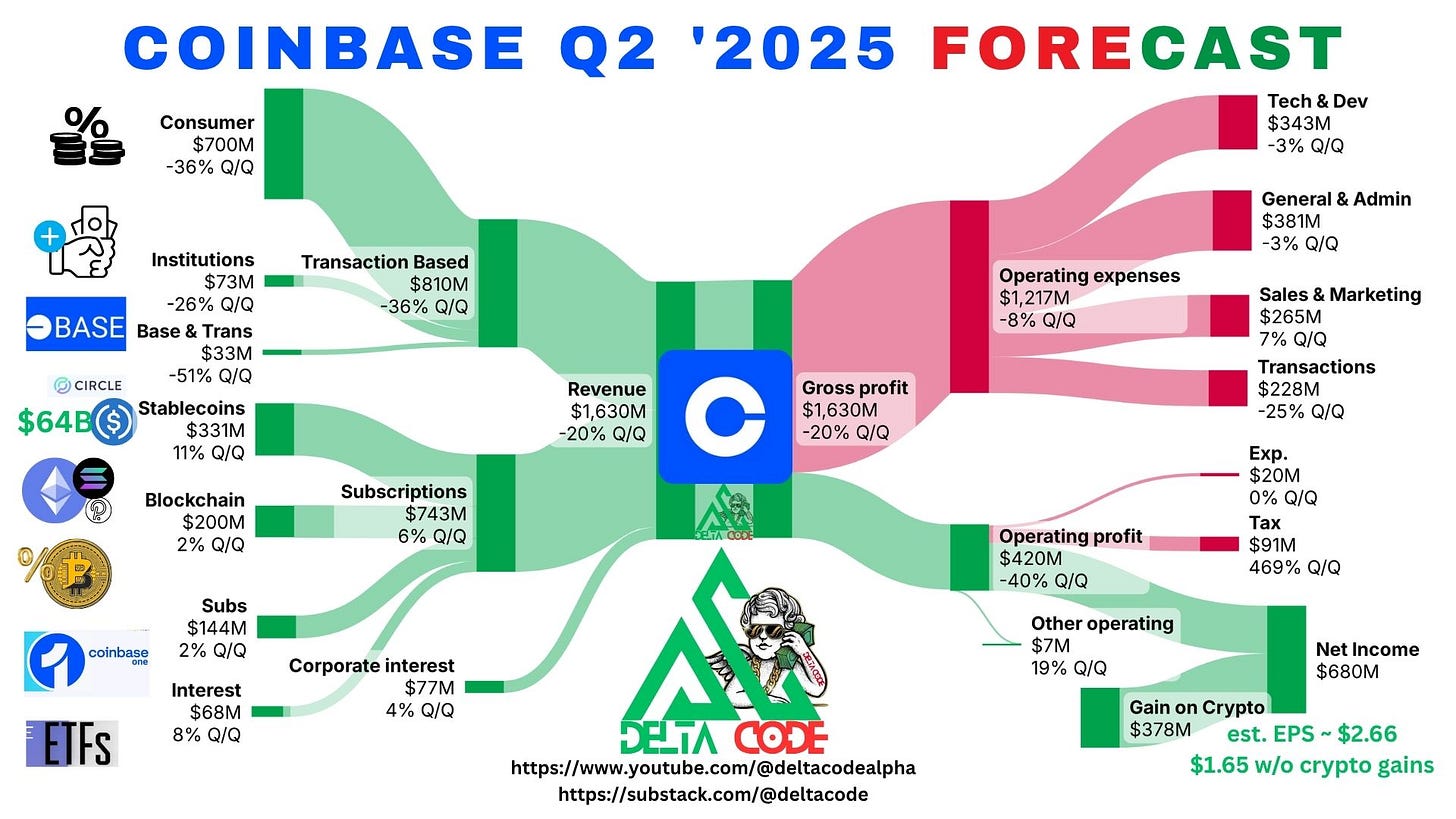

Here is my forecast, which was published last week before the earnings results: Should you BUY or SELL Coinbase $COIN before the Q2'2025 Earnings? See full post for a detailed analysis and outlook. Thesis has not changed after last week’s earnings. Caveats in the preview did warn that results and guidance can be interpreted differently by the market.

As I guided in my preview, Q2 2025 was not going to be as good as Q1 2025. Net revenue came in even lower due to lower transactions, subs, and blockchain rewards than my estimates. Stablecoin revenue estimate was only ~1m different than the results.

To be fair my forecast was not as spot on as usual due to a few unexpected line items, but overall still roughly right on most important items.

Here is the results visual. Notice the Other income of $1.5B from strategic investments most notably its stake in Circle Internet Group. This gave a $5 boost to the EPS, without which EPS would be only about $0.12 EPS. But, Coinbase has invested in hundreds of startups in the crypto space, and some are showing amazing returns. Going forward, many investors will begin to see that Coinbase Ventures operates much like a venture capital firm, and the outsized returns will be realized.

Keep reading with a 7-day free trial

Subscribe to Delta Code to keep reading this post and get 7 days of free access to the full post archives.