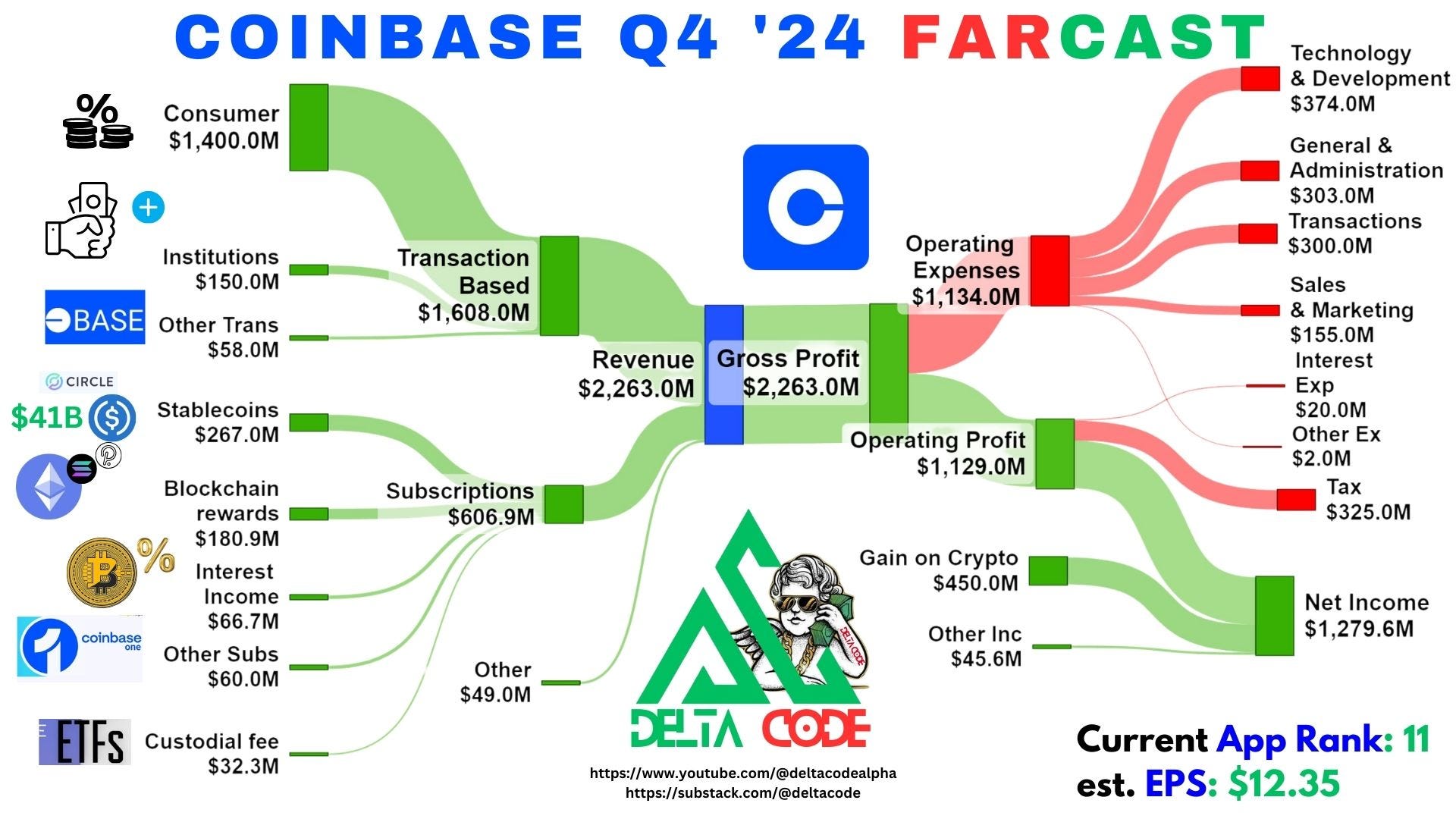

Coinbase $COIN Q4 Far-Cast

Why I am Still All-In Coinbase Stock $COIN

$COIN Coinbase stock is looking to pop-off once the market realizes what we can see in my Far-Cast.

Full forecast comes out in January with fewer assumptions and guesstimates, but for now this is as good as it gets.

Possible inclusion into S&P 500 and QQQ index might be a tail wind market isn’t pricing in.

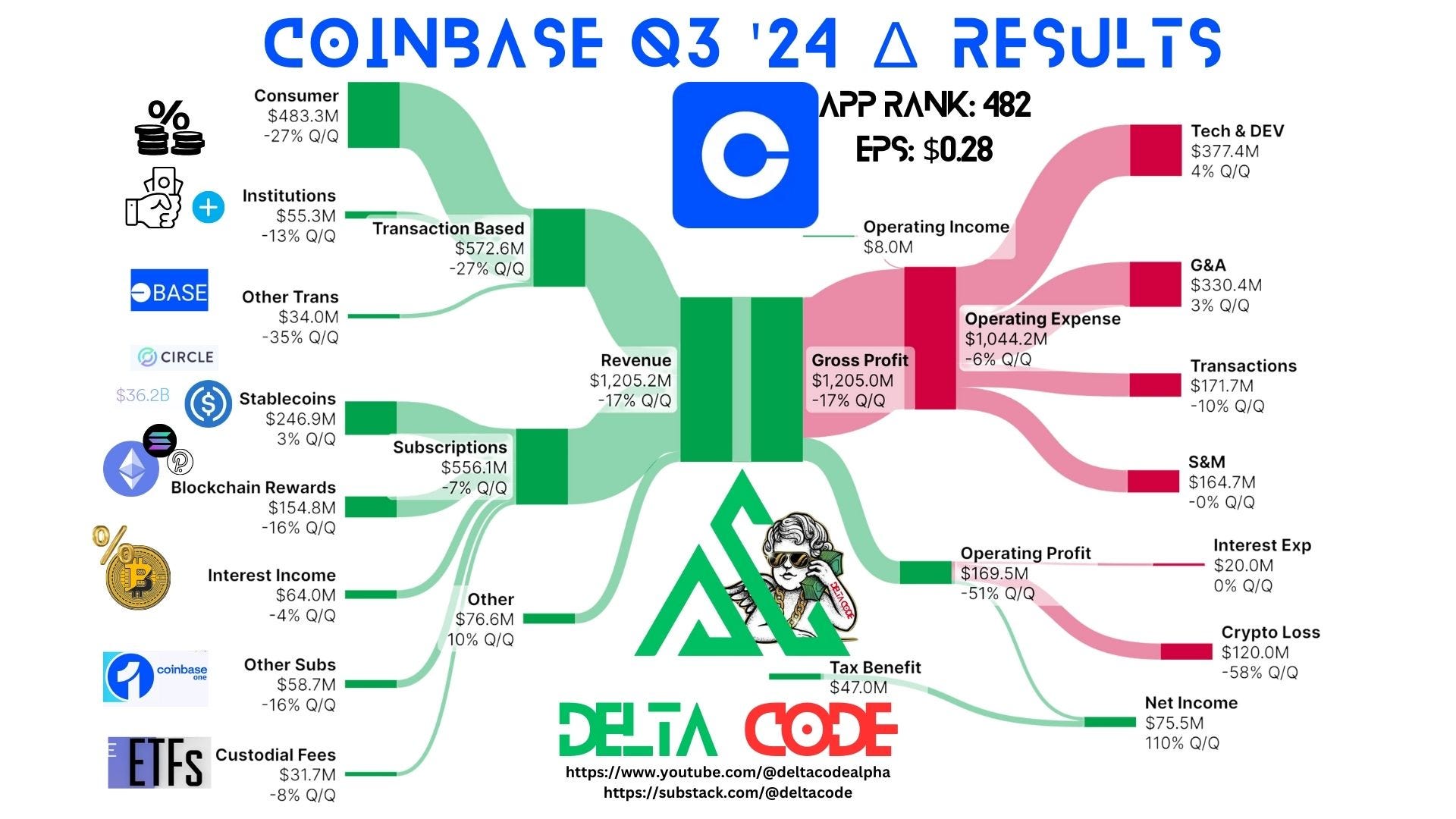

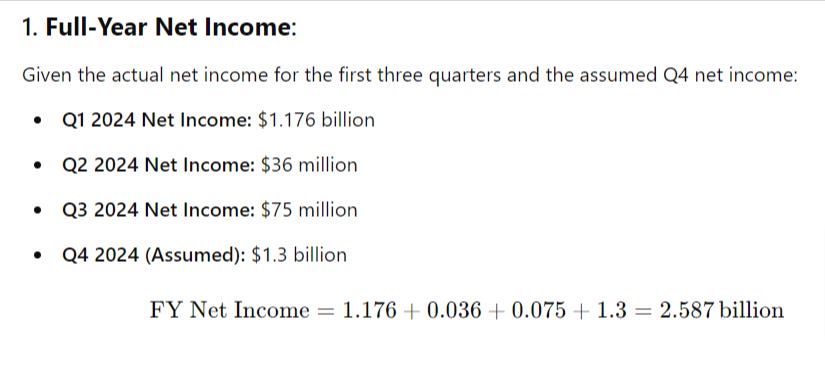

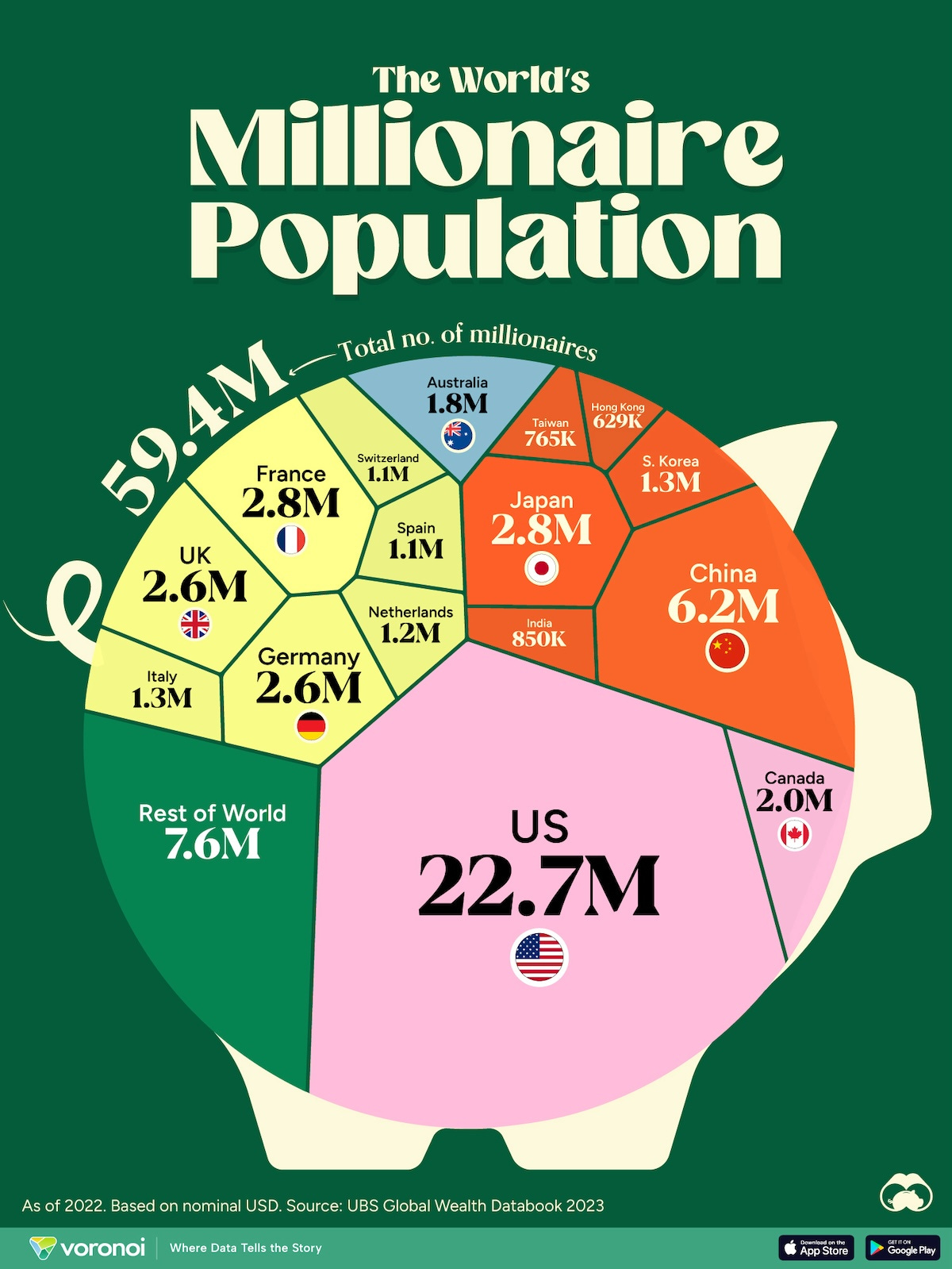

Compared to Q3: EPS is Full year Above and Q3 only below but still a massive Net Income jump from $75M to over $1 Billion.

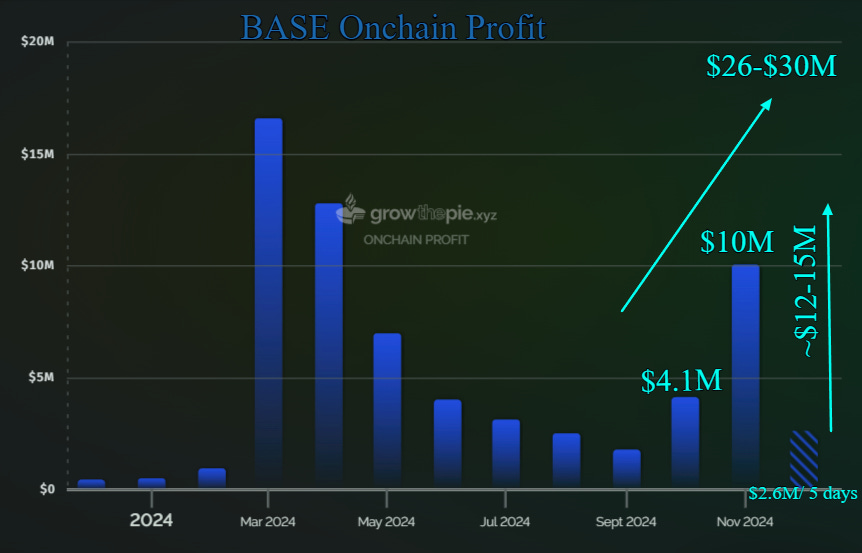

Base Layer 2 income is increasing steadily as Base takes the lead in the L2 of Ethereum ecosystem despite lowered fees, usage is going parabolic making up for lower take rate.

Consumer transaction fees are also hitting record high numbers adding to what is shaping up to be one of the best quarters in the companies history.

USDC Market cap is at $42B which means there will be an increase in stable coin revenue in Q4.

Staking rewards will also see a boost of about 50% give the uptick in SOL and ETH prices.

Bitcoin recently hit a All-Time-High ATH of $104,000.

Let me say that again, BTC is over $100K per coin!

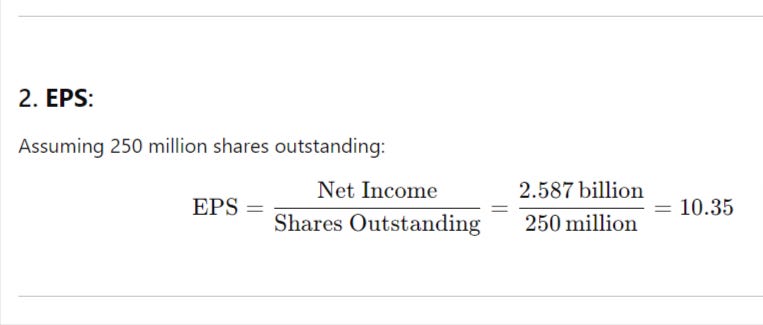

Valuation Calculations

FY Net Income: $2.587 billion

EPS: $10.35

P/E Ratio: 33.83

These figures reflect the updated Q4 assumption of $1.3 billion net income and a price of $350.

Some of this growth is priced in but, not all, and due to the historic volatility of this industry investors do not expect this level of revenue, growth. and profitability to persist. At some point the music stops and the market crashes and Coinbase transaction revenue drops as the bear market scares off retail investors.

OR

Maybe the institutional investors are here and they may have diamond hands like crypto die hard cohort and are familiar with volatility enough to expect it and embrace it as an opportunity to accumulate. The BTC and ETH ETFs are seeing record inflows.

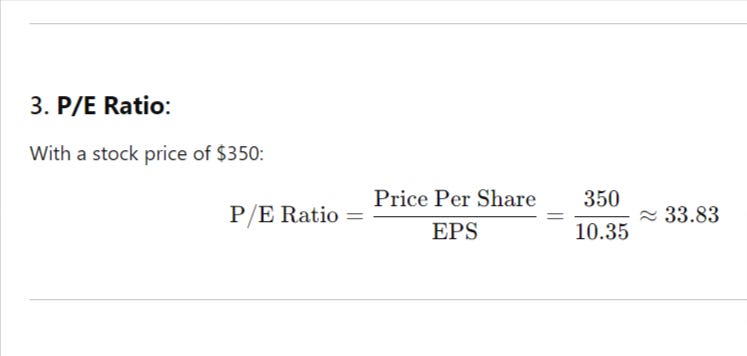

Bitcoin is aiming to take the #1 spot on this list away from Gold. In order to do that it needs only 10X from here.

Which may seem like a tall order but, it isn’t as unlikely as it seems.

China and El Salvador and many other countries are reporting massive gold deposit discoveries. Which means this scarce yellow metal isn’t as scarce as we thought, but BTC is becoming more scarce each day.

Not Every rich person can even buy 1 BTC even if they wanted to. There just isn’t enough of it, and unlike other commodities that see the demand grow past supply at the current price, you can’t make more just because the price is up.

There are 243,000 are classified as ultra-high-net-worth individuals (UHNWIs) with net worth’s exceeding $50 million, they will buy some. But the Millionaire population of the world means, that each millionaire can own only a fraction of a BTC and the fraction is only getting smaller.

There will ever exist on 21 million BTC. Current circulation is 19.79M BTC with only about 3 new BTC being mined every 10 minutes.

ETF’s alone are demanding more BTC than the miners are producing, which means Price will go up.

How long will the price go up?

The price will go up FOREVER! denominated in dollar terms.

Don’t over think it. It is simple supply and demand dynamics.

Simple word of advice:

Dollar cost average, and if and when there is a pullback greater than 30% consider allocating more.

I am mostly holding and adding to to my ETH position as I expect it to outperform BTC and to be the safest, risk reward profile for my portfolio.

In any case: I’m not selling my ETH or COIN shares at any price we might see in the near term.

I expect each $ETH to be worth $32K in not to distant future and Coinbase to be worth $1 Trillion, until that time I am staking my ETH and selling out of money covered calls on my Coinbase shares.

Catharsis

I recently revisited my own article “Crypto Tulipmania” which I wrote while in Netherlands last April. It gave me the framework and the calm necessary for this phase of the market we are currently in.

It was a trip reading it again; it felt like talking to myself through time. There are some nice gems in there if I do say so myself. Give it a look see if you haven’t already!

What price and duration are you selling covered call for $COIN? I plan to sell 90 days @380-400.