Alpha Card: Weekly Investment Idea MU (Micron Technology Inc.)

a leading global provider of memory and storage solutions

Micron’s Q3 earnings smashed expectations. From record-breaking data center revenue to strategic U.S. manufacturing expansion, Micron is executing with high conviction in the AI memory arms race.

In this week’s Alpha Card newsletter, we spotlight one of the few U.S.-based semiconductor leaders scaling AI infrastructure: Micron Technology. From triple-digit income recovery to strategic positioning in the HBM arms race, Micron is leveraging memory upcycle momentum. We break down its fundamentals, valuation, and upside potential for investors looking to ride the AI wave.

📌 Company Overview

Micron Technology (MU) is a leading global provider of memory and storage solutions. It manufactures DRAM, NAND, and NOR memory chips used in everything from smartphones and PCs to data centers and AI workloads. Its main competitors include Samsung, SK Hynix, (both which we covered in a S. Korea deep dive : Betting on Korea's Titans, With Eyes Wide Open) and Western Digital. Micron is uniquely positioned in the U.S. as a strategic memory supplier.

🧠 Core Value Proposition

Micron enables high-performance computing through cutting-edge memory like HBM and LP DRAM, now vertically integrated into AMD, NVIDIA, and AI ASIC pipelines. Its strategic U.S. fab expansion and R&D-backed tech roadmap (1-gamma DRAM, G9 NAND, HBM4) position it to lead the AI memory race.

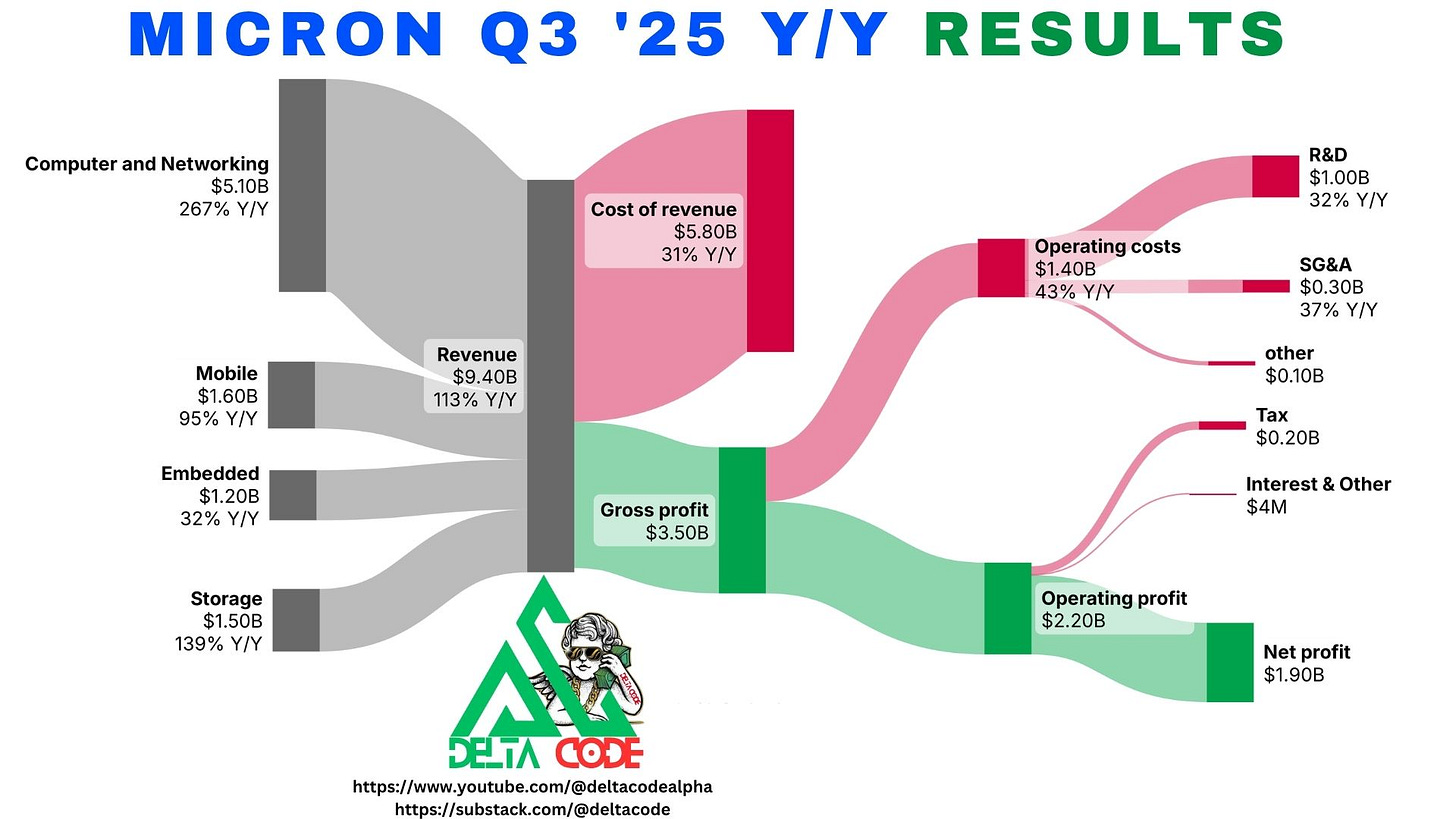

📈 Financial Highlights (Q3 FY2025)

Revenue: $9.3B (+37% YoY, +15% QoQ) ✅

Gross Margin: 39.0% (up from 28.1% YoY)

Net Income (Non-GAAP): $2.18B

EPS (Non-GAAP): $1.91 (vs. $1.36 prior)

Free Cash Flow: $1.95B

CapEx: $2.66B (toward HBM, fabs, R&D)

Liquidity: $15.7B

Next Q Revenue Guide: $10.7B (+15% QoQ expected)

🧾 Alpha Card

Keep reading with a 7-day free trial

Subscribe to Delta Code to keep reading this post and get 7 days of free access to the full post archives.