📌 Company Overview

Hims & Hers Health runs a direct-to-consumer Telehealth platform. Customers complete an online intake, clinicians prescribe if appropriate, and Hims ships medications and care plans from its own pharmacies. You answer questions online, a real clinician reviews, and the medicine shows up at your door. Key focus areas include hair loss, sexual health, mental health, dermatology, and weight management, with growing use of personalized treatment plans.

🧠 Core Value Proposition

Convenient, recurring, personalized care with vertically integrated fulfillment, which improves margins and retention while enabling rapid product iteration. Management highlights rapid adoption of personalized plans and a plan to expand internationally via the pending ZAVA acquisition. (Hims Inc.)

HIMS at a glance

Q2 2025 revenue: $544.8M, +73% YoY.

Net income: $42.5M. Adj. EBITDA: $82.2M with a 15% margin. Gross margin: 76%.

Subscribers: >2.4M, +31% YoY. Monthly online revenue per avg subscriber: $74, +30% YoY.

Marketing expense 40% of revenue GAAP, 39% non-GAAP.

FY25 guide reaffirmed: revenue $2.3B to $2.4B and adj. EBITDA $295M to $335M.

85%+ long-term retention and payback < 1 year.

Regulatory overhang context: FDA declared the semaglutide shortage resolved with 60 to 90 day wind-down for compounded copies. HIMS says it continues to offer certain compounded GLP-1s consistent with exemptions and has added generic liraglutide and access to branded tirzepatide on platform.

Valuation snapshot (approx.): Market cap about $10.5B to $11.1B. EV ≈ $10.9B. TTM revenue ≈ $2.01B and TTM adj. EBITDA ≈ $279M.

Implied EV/Sales ≈ 5.4x TTM, EV/EBITDA ≈ 39x TTM. On FY25 guide midpoints, EV/Sales ≈ 4.6x, EV/EBITDA ≈ 34.6x.

✅ Bullish Thesis

High growth at scale with improving profitability and large cash reserves.

Vertical integration and personalization support high gross margin and retention dynamics.

New geographies and categories expand TAM beyond the U.S.

Substantial short interest can amplify upside on positive catalysts.

Bull case:

HIMS is executing a consumerized, subscription-heavy care model with strong unit economics. Cohorts are monetizing through personalized treatment plans across conditions, driving higher ARPU (Average revenue per user) and retention while marketing leverage improves. The platform handled a large weight-loss influx and is broadening access to generic liraglutide and branded agents, plus ongoing multi-category expansion and early EU scaling via ZAVA. If management sustains >40% YoY top-line through FY25 with EBITDA scaling into the teens, the current ~4.6x EV/Sales on FY25 is defendable for a durable consumer health platform.

Bear case:

The weight-loss pillar faces regulatory and supply risk around compounding, and GLP-1 mix compresses gross margin. Marketing remains a large spend line, and Q2 free cash flow was negative given inventory and pharmacy buildout. Competitive pressure from pharma brands, large retailers, and other tele-health operators could raise CAC ( customer acquisition cost) or cap ARPU gains. Any enforcement that narrows compounding flex could force a mix shift that slows ARPU growth.

Overall:

Quality operator with real scale, strong product velocity, and improving operating leverage, but the stock already embeds high growth. At ~35x FY25E adj. EBITDA, upside likely needs continued ARPU lift, stable CAC paybacks, and a clean regulatory path for its GLP-1 strategy.

What to watch next

GLP-1 policy and litigation outcomes that might alter compounding pathways.

ARPU and mix trends as branded and generic options expand.

Marketing leverage and free cash flow normalization as pharmacy investments taper.

New Products: Blood testing + customized medicine based on blood test. Not confirmed but, looking at their job posting it seems to be int he works.

The hedge, if we are wrong or very right

Position sizing: cap core at 2 percent to 3 percent of portfolio given policy and supply sensitivity.

Options: buy 3 to 6 month 20 percent out-of-the-money puts as downside insurance around FDA or supplier headlines.

2X Leverage if conviction high, but more on that at the end.

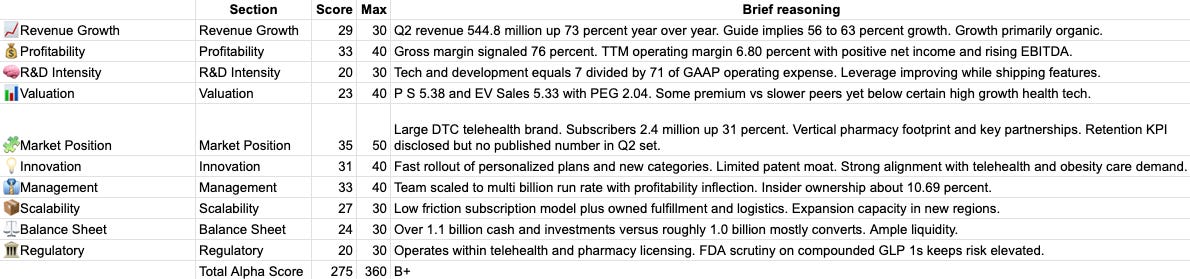

🧮 Alpha Card

🧠 Overall Alpha Score

Keep reading with a 7-day free trial

Subscribe to Delta Code to keep reading this post and get 7 days of free access to the full post archives.