ASML is a Dutch company that develops, manufactures, and services advanced lithography systems for the semiconductor industry. The company is the world's leading supplier of photolithography equipment, which is essential for manufacturing computer chips. ASML's extreme ultraviolet (EUV) lithography systems are critical for producing the most advanced semiconductors used in smartphones, computers, and AI applications.

Business Model

$ASML generates revenue through three main streams:

(1) Sales of new lithography systems, which command premium prices due to their technological complexity and market leadership

(2) Service and maintenance contracts that provide recurring revenue throughout the equipment lifecycle

(3) Spare parts and upgrades. The company operates with high gross margins due to its technological differentiation and limited competition, particularly in EUV systems where it holds a near-monopoly position.

Roadmap Initiatives:

High-NA EUV systems for next-generation 2nm and beyond semiconductor nodes,

Expansion of installed base as more fabs adopt EUV technology

AI chip demand driving increased semiconductor capex

Potential resolution of China export restrictions,

Development of holistic lithography solutions including computational lithography and metrology integration, and

Next-generation EUV technology improvements for higher productivity and lower cost per wafer.

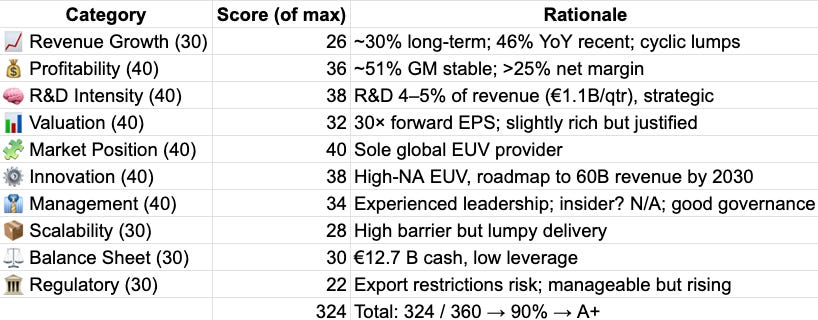

Investment Thesis

Key Strengths:

- Near-monopoly position in EUV lithography with 90%+ market share

- Exceptional profitability with 35.4% operating margins and 28.3% net margins

- Strong technological moats with patents and IP that are extremely difficult to replicate

Key Weaknesses:

- High valuation multiples (P/S 10.23, P/E 30.39) leave little room for execution risk

- Significant regulatory and geopolitical risks from China export restrictions

- Low insider ownership (1.4%) indicates limited management alignment with shareholders. Rookie numbers I would like to see them pump way up.

Astrology For Men a.k.a. TA

Keep reading with a 7-day free trial

Subscribe to Delta Code to keep reading this post and get 7 days of free access to the full post archives.